I surround myself with highly regarded professionals who support my clients and myself. This allows me to focus on one core thing; helping people obtain their real estate goals. Yesterday my client Jim called me and wanted to know more about the possible mortgage cut to a 4.5% mortgage interest rate. The following a fantastic email from Vince Wirthman of 1st Western Mortgage in Berkeley you can contact him at 510-527-2840.

If you have questions regarding home values or Oakland-Berkeley real estate, click the email button on the side of this blog, (deidrejoyner@gmail.com) or call me at 510.693.4253

Alright, everybody take a breath and let’s talk about what REALLY is going on.

Business television and newspapers are abuzz this morning with talk of "four and a half percent mortgage rates". The talk stems from a leaked story that the U.S. Treasury MAY intervene in the mortgage market, IN AN ATTEMPT to lower rates by AS MUCH AS a full percentage point below their current levels. Wow. That’s pretty specific.

As cited by the more responsible journalists however, the story is 100% speculation. Naturally, that doesn't stop the press from covering it. And, of course, it creates a wild frenzy of excitement in the real estate and mortgage industry and for homeowners. My message to Realtors and homebuyers in escrow or house-hunting and to homeowners who are refinancing is simple, and I state this with the full knowledge that at first glance some will think this self-serving – do not make the mistake of thinking that this hub-bub about 4.50% rates is a done deal. Do not stop your transactions or house-hunting based on something that may just as easily not happen. Talk this over in detail with your Realtor and mortgage professional and determine, for YOUR specific situation, what is the best course of action. As is the case with all things speculative, it's important to remember to look at the facts and not be swept up by the media-sponsored frenzy. So what are the facts? Here’s what we know:

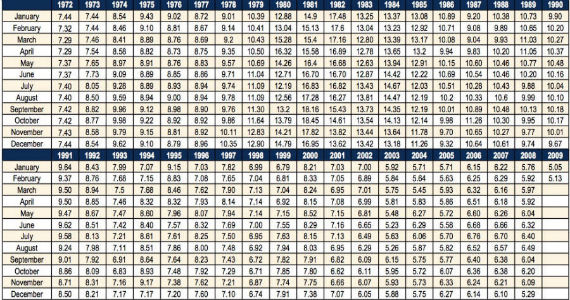

1. The Fed and the Treasury do not set mortgage rates – Mortgage-Backed Securities traders do, based on simple supply and demand. Look at the chart below. This is today’s chart of the price of mortgage-backed securities. Notice that nothing significant has happened today (last green bar to the right). Right now, the price of mortgage-backed securities is up only 12 basis points. Price going up means rates improving. 12 basis points is nothing, and won’t even get a lender’s attention. Note also that on Tuesday, Nov. 25th (tall green bar 6 bars to the left of today), when the Fed announced their plan to purchase $500 Bn of mortgage-backed securities, prices immediately shot up 156 basis points. That move gave us an immediate improvement in mortgage interest rates of .50%. and that was before the Fed spent even $1 on any mortgage-backed securities. That is because the market is forward-looking and prices-in known factors immediately. Today’s speculative rumor has given us nothing, so obviously traders and mortgage bond investors do not believe it. Mortgage rates have actually worsened in the last 3 days.

2. Treasury or Fed intervention doesn't guarantee low rates indefinitely. The fact that mortgage rates are up by a quarter-percent since last week proves it.

3. Zero details about the plan have been confirmed. Everything you've heard about 4.5 percent rates is a guess at this point.

In order to ground my conclusions for this email, I sought out everything I could find about this story and have included some excerpts below for your review. Note that the language in these reports is purposely vague and quite weak. Maybe this rumor ends up being partially true, maybe it doesn’t. There are many reasons why it could happen, and there are many reasons why it wouldn’t. If something does happen, rates COULD go lower SOMETIME in the future. If nothing happens, rates could be higher by the time we know nothing is happening. We will just have to see how things develop from here.

“The Treasury’s consideration of additional efforts to breathe life into the housing market was first reported on The Wall Street Journal’s Web site. People familiar with the Treasury’s plans said that Treasury officials had met with top executives at Fannie and Freddie last week but that neither had been notified that any steps were taken toward putting such a plan into effect. By one account, the new program would be available only to home buyers, not to people who simply want to refinance their existing loan at a lower rate.” via NYTimes.com

Mortgage News Daily - The Journal reported that the government would encourage banks to issue new mortgage loans at lower rates by offering to purchase securities backed by the loans at a price equivalent to the 4.5 percent rate, funding the program by issuing Treasury debt at 3 percent. The Treasury Department plan is only in the talking stage and may not be ready until after President Bush leaves office on January 20 at which point it would be necessary for President-elect Obama to sign off on it.

CNN Money - Lobbyists are pushing the Treasury Department to consider a plan to purchase mortgage-backed securities in the hopes of driving mortgage rates to as low as 4.5%, an industry source said. Spokeswomen from Treasury and the Federal Housing Finance Agency, which oversees Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), declined to comment.

"It is clearly designed to bring buyers into the marketplace and soak the inventory of unsold homes," said Greg McBride, senior financial analyst at Bankrate.com. But others questioned whether rates would remain low and, even if they did, only a narrow slice of credit-worthy borrowers would benefit. Rates are already inching up, hitting 5.75% on Wednesday, said Keith Gumbinger, vice president of HSH Associates. Several government attempts to lower mortgage rates this year have failed to have a lasting effect.

Finally, super-low rates could keep private investors out of the mortgage-backed securities market, forcing the government to remain the primary buyer of such investments, Gumbinger said. "I can't imagine there will be a significantly active marketplace of people who want to buy at these low rates," he said. (That would not be an acceptable long-term situation, and the Treasury knows that.)

Thomas Vanderwell had this to say on his blog “Straight Talk About Mortgages:

“So far, the market has shown that they would rather earn less (frankly close to zero) and invest in US Treasuries than they would invest in mortgage backed securities. Given the history of Fannie and Freddie recently (how many billions did they lose in the 3rd quarter?) I’m not sure anyone can blame them. Can you?

So if investors are avoiding Mortgage backed securities like the plague, and there are trillion of dollars of them out there, will the interaction by the Fed make a difference? And if no difference is made, how will we get 4.5% mortgage rates? And if we do not get these 4.5% mortgage rates that homeowners will now expect, how in the world are we going to sell homes to people waiting for cheap mortgages?

Governor Schwarzenegger, is trying to pass a statewide tax credit for new and existing home purchases starting May 1st, 2010.

Governor Schwarzenegger, is trying to pass a statewide tax credit for new and existing home purchases starting May 1st, 2010.