Source: The Home Co. Realtors

751 47th St, Oakland

3,845 sq ft | List Price $899,000

Your Custom Text Here

Source: The Home Co. Realtors

751 47th St, Oakland

3,845 sq ft | List Price $899,000

If you are active in the Oakland, Berkeley real estate market then you are aware we are in a seller's market and you have likely heard about all of the non-contingent offers. In a seller’s market there are typically multiple bids on a property. When a buyer writes a competitive offer in an attempt to win the bidding war there are three main contingencies to consider; the inspection contingency, loan contingency, and appraisal contingency. These contingencies are in place to protect the buyer, however, a buyer can choose to waive any or all in an effort to strengthen their offer and make it more appealing to the seller. I write many non-contingent offers for clients but I only do this when my clients have a thorough understanding of the risks and implications involved with writing and submitting a non-contingent offer.

When writing an offer with no contingencies, you are telling the seller that should you cancel, for any reason, you are aware that you are at risk of losing your earnest/initial deposit money.

Because the appraisal is an aspect of the escrow that is determined by a third party, I'd like to further address the appraisal contingency in more detail. Every house purchased with a loan has an appraisal performed. The hope is that the property appraises at the offer price. Sometimes, in a seller’s market, bidding wars can cause appraisals to come in lower than the purchase price. When an appraisal contingency is in place, an appraisal that comes in lower than the contracted purchase price allows the buyer the opportunity to potentially renegotiate the offer price with the seller. In contrast, if a buyer decides to waive the appraisal contingency, they have to be prepared to increase their down payment to cover the difference in the appraised value and their offer price.

Real World Example:

You are offering $900,000 on a home and it is your goal to buy a home with a 20% down-payment ($180,000 cash/$720,000 loan).

The appraiser comes out and appraises the home at $880,000. You have waived your appraisal contingency, so you will need to have funds to cover the 20% down-payment, of the appraisal price ($176,000) plus an additional $20,000. See below:

$176,000 adjusted down-payment based upon 20% of the appraisal value +

$20,000 additional down-payment +

$704,000 adjusted loan amount = $900,000

Why do the numbers change? A 20% down-payment loan program is based upon the appraised value, not the offer price. The seller accepted your offer at $900,000 and you wrote your offer saying you would pay $900,000, even if it does not appraise at this price.

What is at stake if you take a risk and do not have the funds to cover the difference? Your earnest money, also known as a good faith deposit. Typically, in our niche market, buyers are placing 3% of their offer price in a neutral escrow account. This money is held there until the escrow officer has mutual instructions from both the buyer's agent and seller's agent. This 3% is applied to the buyer's down-payment, unless the buyer breaches their contract. "Breach" means backing out for a reason outside of your contingencies or reasons not permissible per the contract. So, if you write an offer with no contingencies, which many buyers are now doing, and you back out because an appraiser values your potential future home for less than you offer, this is considered a breach of contract.

I hope this explanation helps you better understand the risks and implications of offers written without contingencies - specifically, an appraisal contingency.

After a busy first half of the year, August greeted me with a slightly more relaxed schedule, which was a blessing because I am gearing up for what I think will be a robust September. Currently I have several buyers looking for homes and several homes getting prepped to hit the market. As I review my business it feels good because it is balanced; there are qualified buyers in search of their next abode and lovely homes getting the final touches to impress their next stewards. When I reflect on my book of business it is so much more than closed deals, it is about the people. Every transaction has a personal story, a life change, a new adventure, and a new beginning. I am so grateful that you share a piece of your life with me!

Last night I was invited over to my clients Lindsay, Kelly and Collins’s home for wine and cheese. It has been less than two months since they closed escrow and they have already put their mark on their new space. One of my recommended arborists came and sculpted the trees that were long overdue for pruning, the wood paneled walls (not the good kind) were removed and replaced with crisp Dove White paint, the light fixtures that were replaced with Rejuvenation lighting (I am able to pass along my trade discount for my clients!), the living room furniture was ordered and delivered, a once-dated fireplace was updated with a wall of white brick, the older Formica and wood bar was transformed with crisp subway tiles installed in a herringbone design, and the bar sink was capped with Carrera marble! After a tour of their home I was handed a chilled glass of rosé and a cheese platter was served. It was so nice to relax and learn more about my clients. After what felt like a brief visit, but was actually 4 hours, I drove home and was filled with gratitude to have people come into my life and stay.

Why do I share my personal tidbits with you? Because you share your hopes, dreams and fears with me. This fall season’s big news is my beloved assistant Kelly is getting married! I am very excited for her as she marries the love of her life. My youngest, my son Miles, just started his senior year of high school. He is a team captain on his football team so on game days I will be screaming for the Saint Mary's Panthers!

My son is #17 Photo credit: James Jackson

This month marks my 12th year in business and I want to thank you, my husband, daughter, son, Kelly and the entire Red Oak staff for the ride!

Happy fall season!

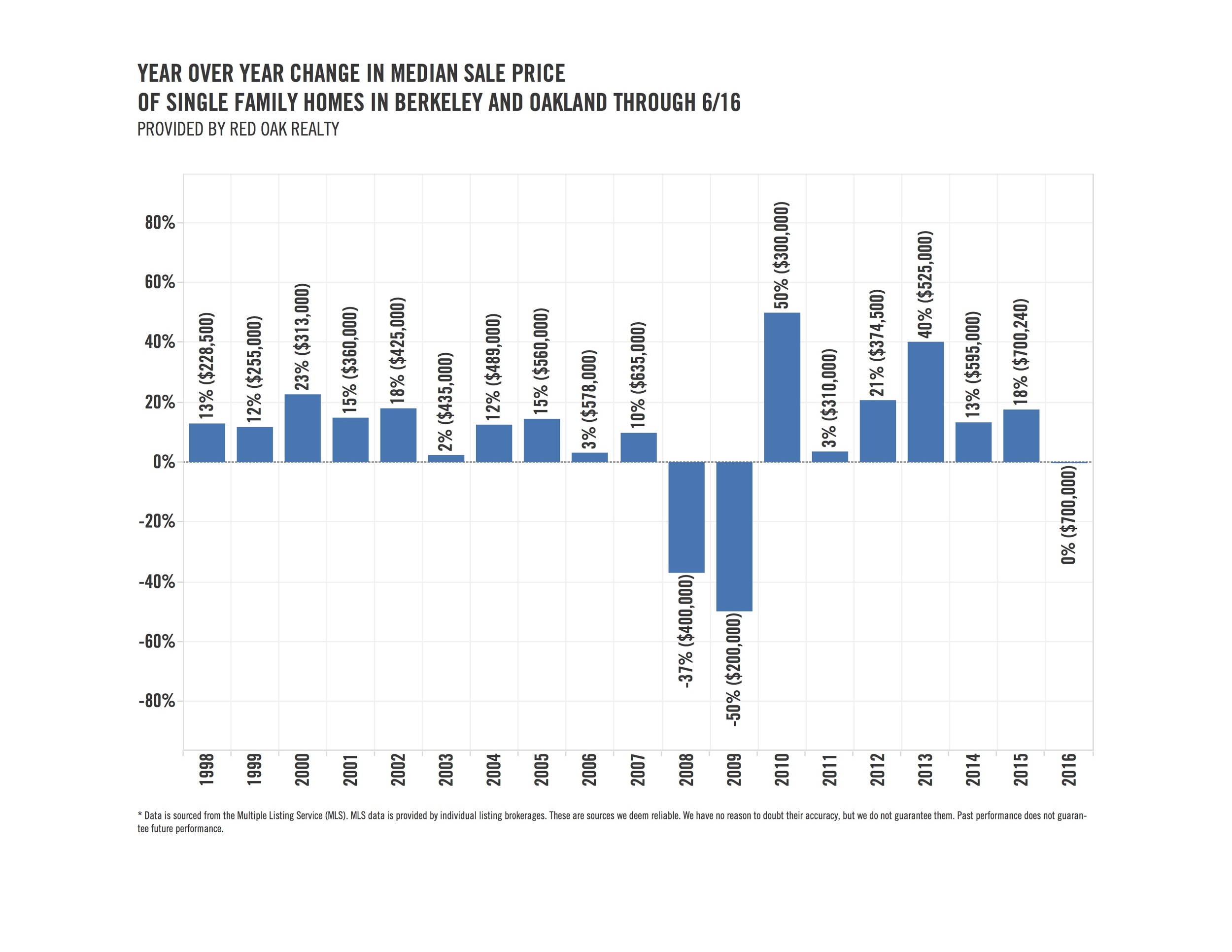

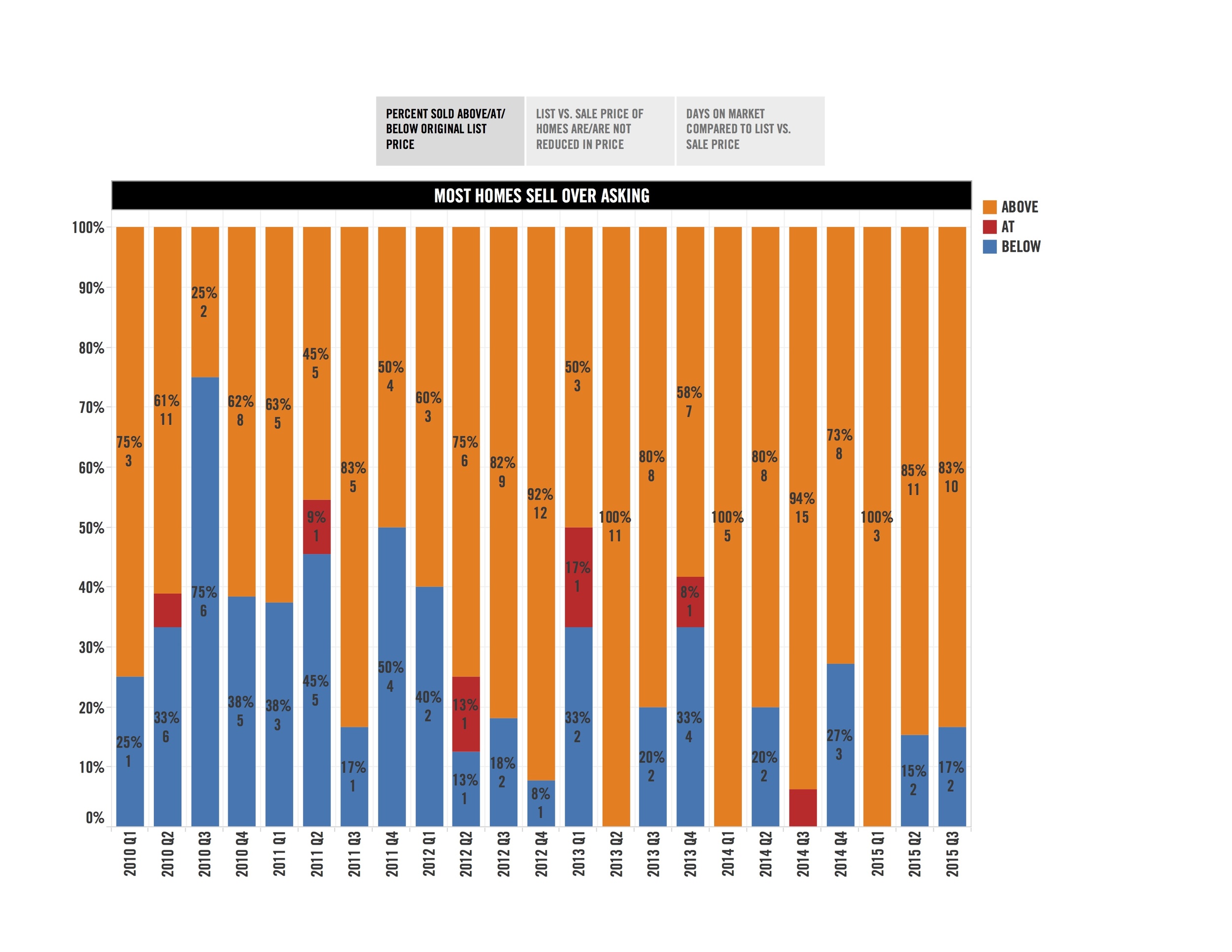

Many people ask me, "Is this a bubble...when will it burst?" So I thought, let's track appreciation versus depreciation in the Oakland and Berkeley real estate market. I tracked sales posted on the local multiple listing service (MLS) back to 1998 and it turns out that we only had 2 years of depreciation, 2008 and 2009. Funny, I remember that the Federal government gave an $8,000 first-time-buyer tax incentive in 2009/2010 that really boosted sales; and we have not looked back.

We cannot predict how future markets will pan out appreciation-wise, but it is good to know that going back 18 years there has been only 2 years of depreciation. This is good data to use in your decision on if or when you should buy.

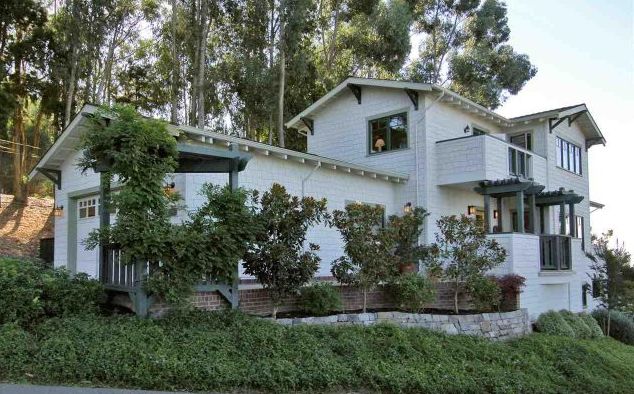

Source: Pacific Union, Jackie Care, Listing Agent

A True Artist's Home - lluminating with style

2974 Burdeck Drive

Anything is possible in regards to our marketplace, however, this is the 4th year of double digit increases and I am wondering how long these property values can be supported. Currently only 22% of Alameda County residents can afford to buy a home. This is an election year and if you wait until the end the year to sell your home things could change in the real estate market depending upon how the election goes. In my experience, property values are driven by a combination of supply and demand, interest rates, jobs, consumer confidence, rent prices and crime rates. If you decide to sell it should only be if you are really done with your home.

In regards to buying a home, economists do think there will be a market correction in the next couple of years. I am recommending that all of my buyers buy for the long term. Think of your equity as ghost equity, meaning it doesn't matter what your home is worth until you are ready to move on and sell. When the market does correct, I do not think people will walk away from their loans like they did before, because many people are buying with heavy cash these days and have a considerable amount of capital in their homes.

I recommend now (as I have for the past 11 plus years), buy something that fits your needs for 7-10 years or more.

A fabulous Oakland Hills home that feels like Sonoma....

5630 Bacon Road, Oakland - Hillcrest Estates

(Source: Rick Richetta, Alain Pinel Realtors)

862 Regal Road in Berkeley took my breath away. Source: Caldecott Properties.

Before: 2013

Current: 2015

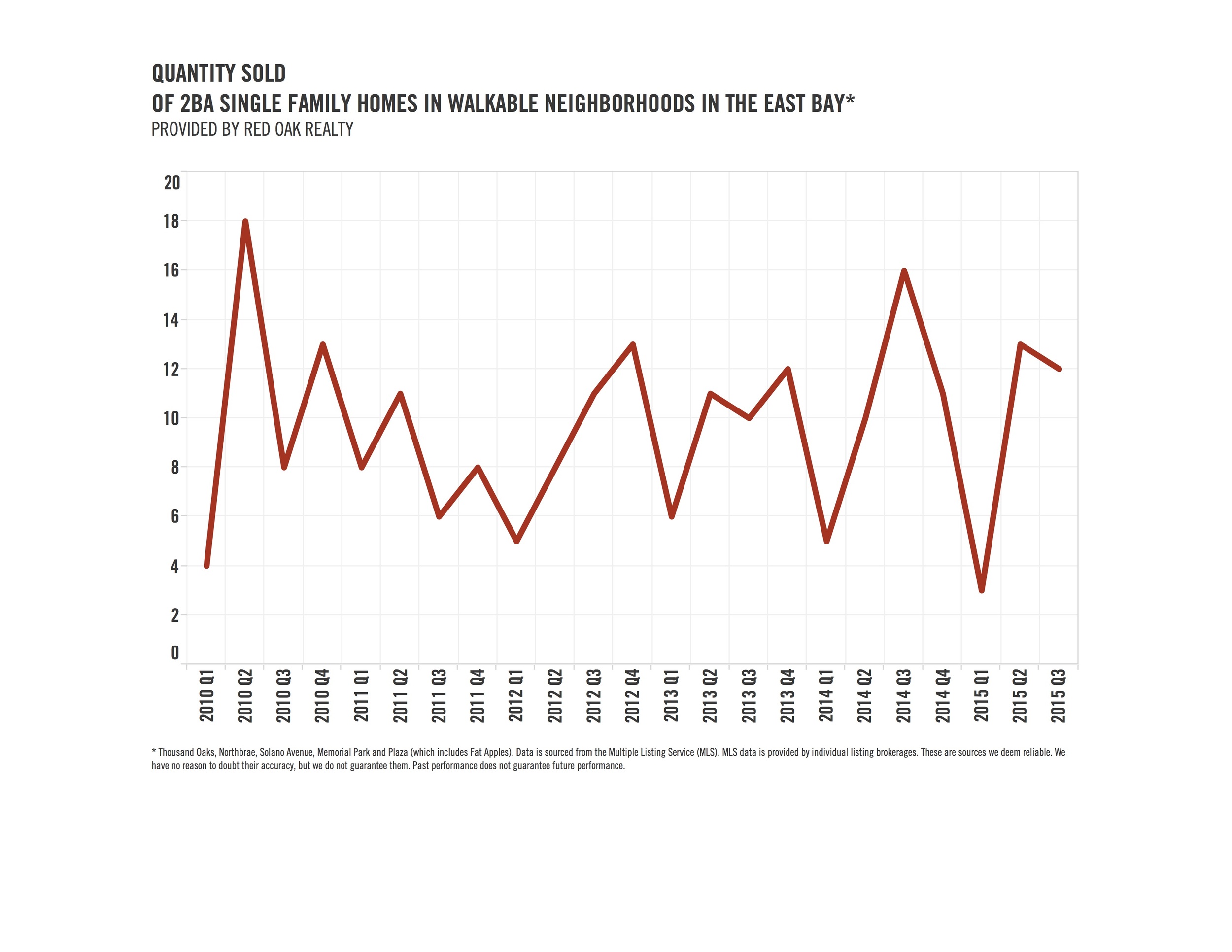

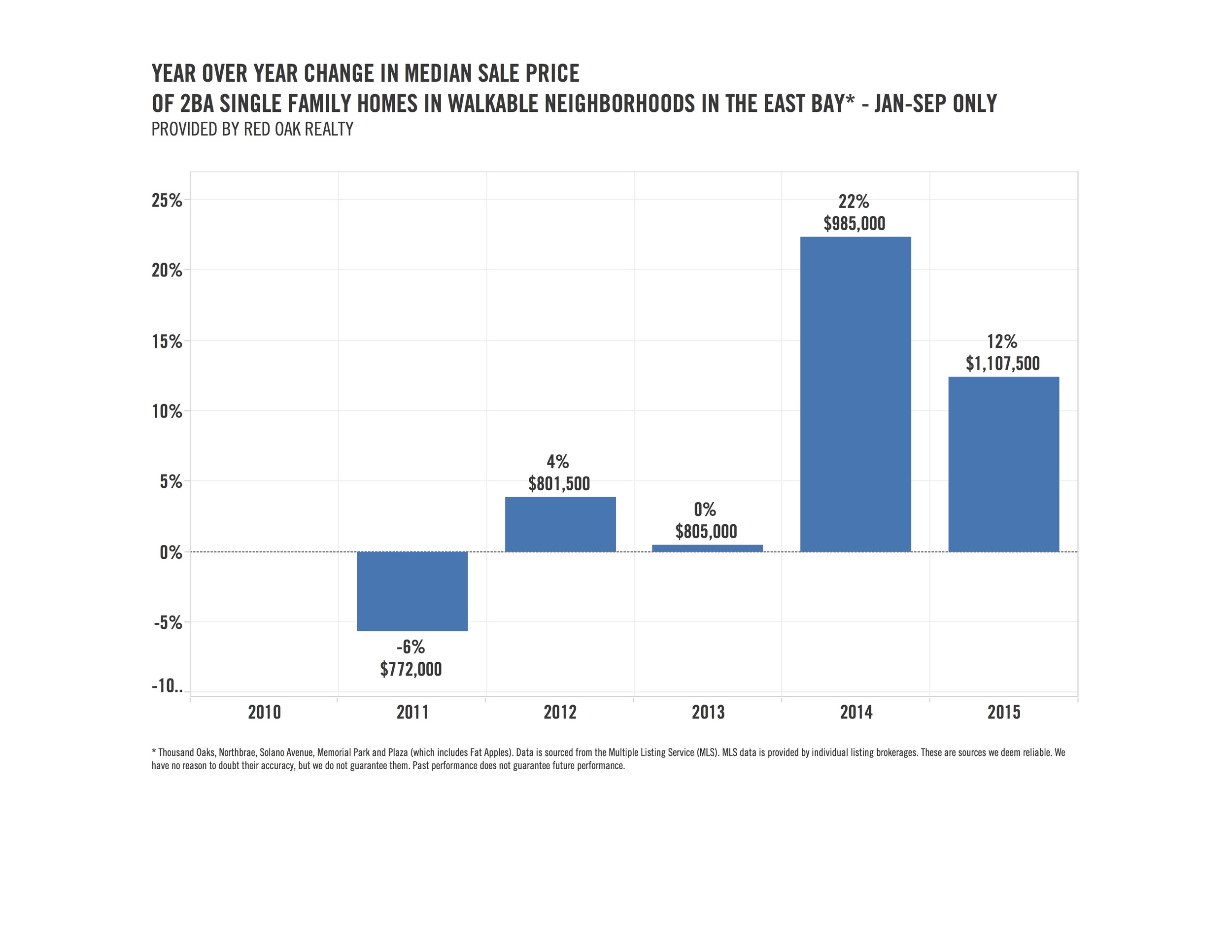

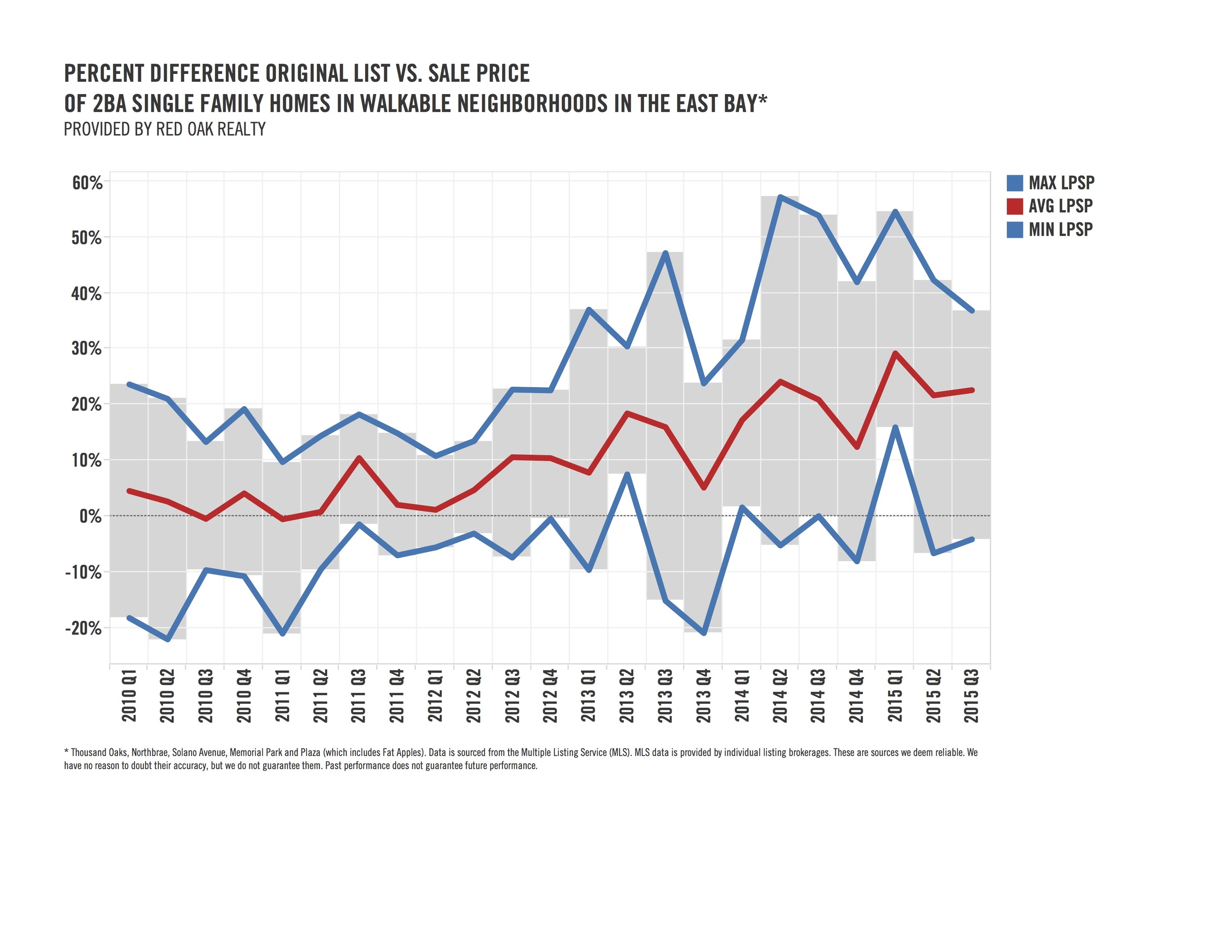

This week a client came to me who is considering a move from the East Coast for retirement. They live in a wonderful community in New York and want two bathrooms. It is funny how two bathrooms is considered a luxury in some highly sought after neighborhoods! They have a son who lives in the Northbrae neighborhood of Berkeley and they really like Solano Avenue area for the walkability. Today I drove them around and had these charts created so they could better understand our market, as it is very important to understand the market as a buyer. Remember, listing price often times has no correlation to sold price.

A Piedmont Pines Beauty, 6550 Castle Dr., Oakland

Source: Kelly & Marvin Deal, The Grubb Co.

This was my favorite house on tour yesterday. A "cool ranch" house. All level living, updated, and an amazing view of what felt like the heavens.

Last week I reviewed offers with three sellers on properties. Each was in a different Oakland neighborhood. The properties are now in escrow, two with accepted offers at more than 20% over the asking price. The third property also did well, but is selling at just 5% above the listed price. Each property received the same treatment: careful pricing to generate maximum interest, meticulous preparation, professional photography, and custom web sites that tracked and verified similar levels of consumer interest. Why did two homes go so high while the third did well, but not as well? The fact is buyers are craving quality inventory. They will pay high prices, but they carefully analyze the suitability and appeal of the home they are buying. Here are some features that add value:

Here are some factors that do not add value:

And then there are location details that typically reduce buyer interest: a busy street, a corner lot, or close to a freeway and its noise. Those external issues affect value and need to be considered when pricing your property and setting your expectations for results.

My job is to get your home sold for the highest price that the market will bring. That begins with helping you benefit from my experience so that you can see your home from the market viewpoint. With this understanding we can work together through any sale confident that, in the end, we attained the best result possible for that house, at that time, in those market conditions..

If you are considering selling your home, let's talk!

For more information please visit the property website:

For more information please visit the property website:

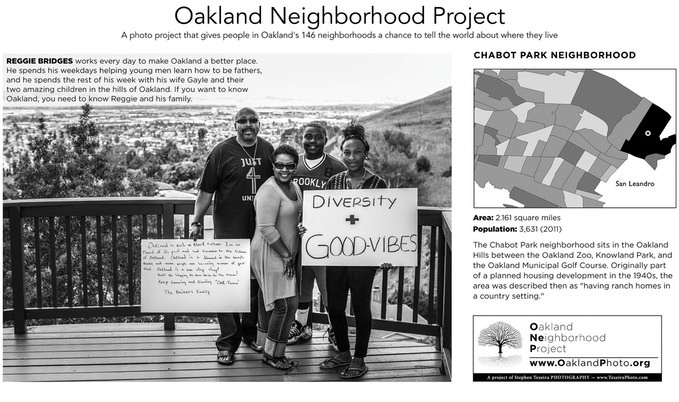

I was happy to make a small donation and even more happy to hear it is now fully funded! Stephen Texeira's The Oakland Neighborhood Project is a very cool photographic story telling about Oakland and its vast array of people. Please click on the links below to find out more! [embed]https://www.kickstarter.com/projects/2056607570/the-oakland-neighborhood-project?ref=checkout_share[/embed]

A huge asset to living in Oakland are the local amenities. Are you utilizing what Oakland offers in your neighborhood? So many of us, are stuck in our routine and do not venture out to explore the oaks and redwoods that are clustered throughout of town. Check out this Trailhead documentary of Oakland that I am proud to be sponsoring and was interviewed for, "Discovering Oakland's Gateway to the Redwoods". We filmed this @Bellanico in the Glenview.

https://oaklandtrails.org/watch/

Stan Dodson and Deidre Joyner

A few weeks ago, I saw this home out on Broker's tour. Over an acre of mainly level gardens and on the market for the first time. 13281 Skyline Blvd is the home of master gardeners and members of the American Rhododendron Society, these grounds are luscious! Listing courtesy of Martha Hill, Pacific Union.

I'm always fascinated by the different homes I get to view on our weekly broker's tour. I really liked the two homes below, listed by GrubbCo. 46 Melvin Court reminded by of a wooden labyrinth puzzle and felt as though it should have a fridge full of Tab Cola.

123 Wildwood Gardens in Piedmont had one fantastic front door, original details and a backyard out of a scene from a movie.

Realtor, CA DRE #01451749 – Red Oak Realty

510 693 4253 / deidre@redoakrealty.com / 6450 Moraga Avenue, Oakland CA 94611

©2024